Did your business employ remote workers prior to the pandemic? Most remote employees today transitioned as a result of pandemic restrictions forced by their home state. Businesses around the country were right to follow these restrictions to ensure the safety of their employees. However, believe it or not, even prior the pandemic the number of remote employees was on the rise. In fact, the 13-year period between 2005 and 2018 saw a 173% increase in remote employees. This was largely in part due to the benefits that remote employees can bring to businesses, but as these businesses would find out, there is also a great deal of inherent risk that must be properly overseen.

One of the first challenges that businesses will face as a result of remote work comes in the form of managing employees. Managers may have a harder time overseeing their staff with little to no face-to-face interaction. The inability to properly communicate, similarly to the way employees communicate in the office, can create some harsh work environments for employees. For example, these employees may find collaborating with other teams throughout the organization much more challenging without the proper form of communication, especially if their responsibilities rely on being able to effectively communicate, These employees also face the danger of feeling isolated from their coworkers the longer they work from home without much interaction.

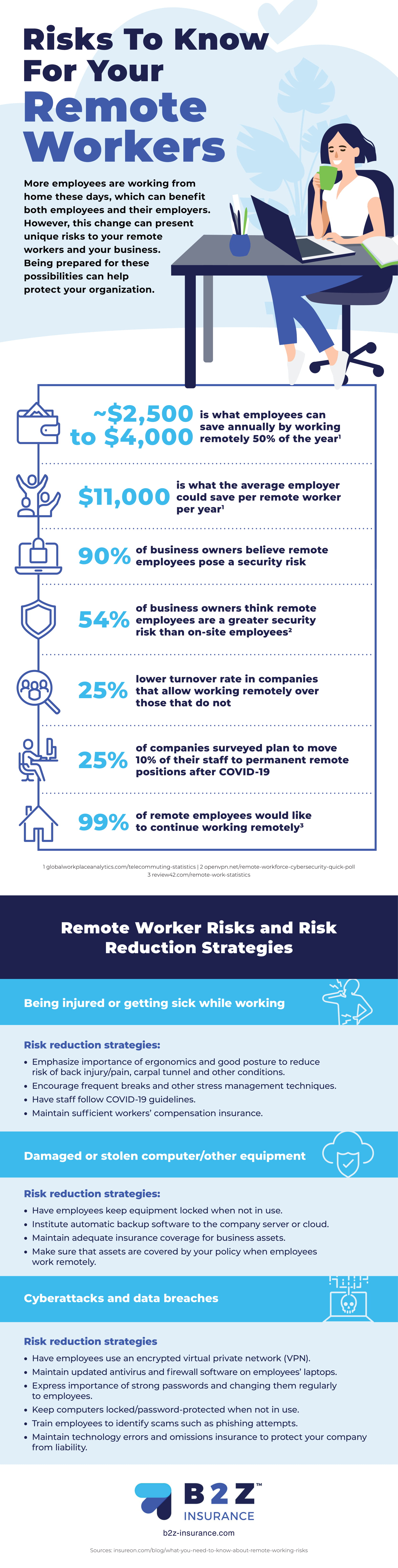

Another element of remote work that must be considered is the additional liability faced by organizations. This ranges from remote employees injuring themselves while at home, all the way to hardware issues such as stolen hardware, or even worse, internal data breaches. Considering these dangers, it’s important for organizations to have the best fitting insurance policy in place to cover these issues. In addition to the right insurance policy, workers compensation must also be considered despite the remote nature of an organization’s’ employees. Similarly to workers compensation for employees in office, those out of office should have the same benefits. Medical bills, paid time away, and more should all be included in a remote employees’ worker compensation package the same way they would be for employees working in office.

The most important risk that organizations should always remain on top of when considering their remote employees has got to be various cyberattacks. The data of your organization and your clients is of utmost importance and should remain safely secured in your network. However, without the proper tools, this data can be accessed by those looking to harm your organization. Prioritizing up to date firewall and antivirus software is a great start, but the most important element to defending your organization is an encrypted virtual private network (VPN).

It’s true that these tools are great for protecting your organization, but a data breach is will always remain a possibility. For this reason, it’s imperative for organizations to have updated cyber liability insurance. At the very least, first-party cyber liability insurance should be of utmost importance of organizations. These polices are meant to cover the damages related to a data breach on your organization’s systems. If your organization works alongside a number of other clients, third-party liability insurance is likely another option to explore. These policies cover the damages that come as a result of your clients’ information being compromised.

While there are many benefits to enabling your staff to be able to work remotely, it is also important to consider the threats associated with this change. For more information on these risks and what your organization can do to mitigate them, be sure to review the resource accompanying this post. Courtesy of B2Z Insurance